Hello friends, this article will be useful for those who want to know about Ethereum. Ethereum is a decentralized international software platform powered by blockchain technology. It is generally known for its native cryptocurrency, ether (ETH). Among cryptocurrencies, ether is second only to bitcoin in market capitalization. This software was originally released on 30 July 2025 and allows anyone to deploy endless and unchangeable decentralized applications onto it, with which users can interact. At this time people want to know how Ethereum works. We have more information about the news and will share it with you in this article.

What Is Ethereum?

Ethereum is a decentralized international software platform and anyone can use this software to make any secure digital technology. It has a token created to pay for work done supporting the blockchain, but participants can also utilize it to pay for actual goods and services if accepted. This software is made to be scalable, secured, decentralized, and programmable. It is the blockchain of choice for designers and enterprises technology established upon it changes how several industries work and how we go about our daily lives. It natively supports smart agreements, an important device behind decentralized applications. Several decentralized finance and other applications use elegant in conjunction with blockchain technology. You are on the right page for more information about the news.

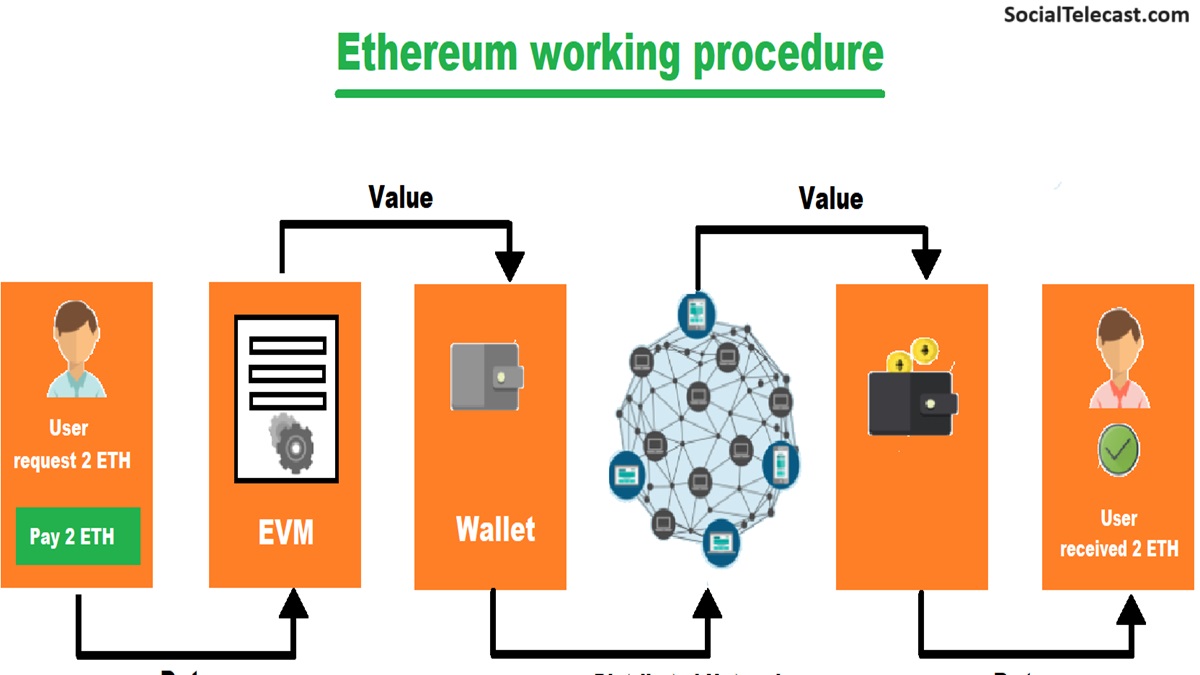

How Does Ethereum Work?

As we mentioned thousands of people want to know about how Ethereum works. Vitalik Buterin, credited with creating Ethereum, issued a white paper to introduce it in 2014. Buterin and Joe Lubin launched the Ethereum platform in 2015. They are the founder of the blockchain software company ConsenSys. The creators were among the first to consider the full possibility of blockchain technology beyond just enabling the safe virtual payment process. Ether as a cryptocurrency became the second biggest cryptocurrency by market value. It has been outranked only by Bitcoin.

What Is Blockchain Technology?

Blockchain Technology is an advanced database tool that permits translucent details sharing within a business network. A blockchain database keeps data in blocks that are connected in a chain. This blockchain is valid by a network of automated programs that agree on the facts of transaction details. No changes can be made to the blockchain until the network comes to a consensus. This makes it very secure. The agreement is made using an algorithm commonly called a consensus mechanism. This software uses evidence validators to make new blocks and works together to confirm the details they contain. This block has details regarding the state of the blockchain, a list of attestation, commerce, and much more.

Proof-of-Stake Mechanism

Proof of stake differs from proof of work in that it does not need the energy-intensive computing referred to as mining to validate blocks. It operates a finalization protocol called Casper -FFG and the algorithm LMD Ghost, mixed into a consensus mechanism called Gasper, which monitors consensus and defines how validators receive tips for work or are punished for deception. Solo validators must stake 32 ETH to start their proof capacity. People can stake smaller amounts of ETH, but they are required to join a validation pool and share any rewards.

A validator makes a new block and attests that the details are valid in a process called attestation, where the block is broadcast to other validators called a board who verify it and vote for its validity. Validators who act dishonestly have been punished under proof of stake. Validators who attempt to attack the network have been identified by Gasper, which places the blocks to accept and reject based on the votes of the validators. Deceitful validators have been punished by having their staked ETH burned and being removed from the network. Burning directs to sending crypto to a wallet that has no keys, which takes them out of circulation. Scroll down to the next page to get the complete information.

- Wallets

Ethereum proprietors operate wallets to store their ether. A wallet is a digital interface that lets you access your ether accumulated on the blockchain. Your wallet has an address, which is equal to an email address in that it is where users send ether, much like they would an email. Ether is not stored in your wallet. Your wallet keeps private keys you use as you would a password when you start a trade. You have a private key for per ether you own. This key is necessary for accessing your ether. That’s why you hear so much about ensuring keys using different.

- Historic Split

One significant event in Ethereum’s history is the hard fork, or division, of Ethereum and Ethereum Classic. In 2016, a company of the network participants gained maturity management of the Ethereum blockchain to steal over $50 million price of ether, which was raised for a project called The DAO. The raid’s triumph was attributed to the involvement of a third-party developer for the latest project. Most of the Ethereum community opted to change the theft by invalidating the existing Ethereum blockchain and approving a blockchain with a revised history.

Also read: What Is Ripple: Overview, History And XRP Cryptocurrency

Ethereum vs. Bitcoin

Ethereum is usually compared to Bitcoin. While the two cryptocurrencies have several similarities, there have been some significant distinctions. Ethereum is represented by founders and developers as “the world’s programmable blockchain,” setting itself as an electronic, programmable network with multiple applications. The Bitcoin blockchain, by contrast, was made only to help the Bitcoin cryptocurrency. The bitcoins maximum number that can enter circulation is 21 million. The amount of ETH that can be made is endless, although the time it takes to process a block of ETH limits how much ether can be minted each year.

Also read: What Is Bitcoin Cash: How Does BCH Work?

The number of Ethereum coins in circulation as of March 2024 is just more than 120 million. Another important difference between Bitcoin and Ethereum is how the individual networks treat transaction processing fees. These fees, known as gas on the Ethereum network, are paid by the parties in Ethereum transactions. The fees associated with Bitcoin trades are absorbed by the broader Bitcoin network. As of 2024, this software uses a proof of stake consensus mechanism. Bitcoin uses the energy-intensive proof of work consensus, which needs miners to compete for rewards. The accord mechanism for Ethereum was utilized to be proof of work, but this changed in 2022.

The Future of Ethereum

There’s a transition to the proof-of-stake protocol, which allows users to validate trades and mint new ETH based on their ether holdings, which was part of an important upgrade to the Ethereum platform. Earlier called Eth 2, this upgrade is referred is directed to only as Ethereum. But, ethereum has two layers. The first layer is the performance layer, where transactions and guarantees happen. The second layer is the consensus layer, where attestations and the consensus chain are supported.

The promotion added power to the Ethereum network to support its development, which will ultimately assist in addressing chronic network congestion issues that have driven up gas fees. Ethereum has been persisting growth of sharding will divide the Ethereum database amongst its network. This idea is similar to cloud computing, where several computers handle the workload to decrease computational time. These more diminutive sections will be called shards, and bits will be worked at the same time, decreasing the amount of time required to reach an agreement through a method called sharding consensus.

Last, Ethereum issues a roadmap for plans. As of March 2024, there were four primary types of categories listed for future work to come on the network. Those changes would push for :

1. Cheaper transactions – Ethereum notes that rollups are very costly and force users to place too much trust in their operators.

2. Better user experiences – Ethereum notes wanting better support for smart contracts and lightweight nodes.

3. Extra security – Ethereum mentions it wants to be prepared for future types of attacks.

4. Future proofing – Ethereum reports wanting to proactively solve issues that have yet to come up.

Use in Gaming – Ethereum is also being conducted in gaming and virtual reality Decentraled is a virtual world that uses the Ethereum blockchain to connect items contained within that world. Land, buildings, environments, avatars, and wearables are all tokenized through the blockchain to make a right. Axie Infinity is another game that uses blockchain technology and has its cryptocurrency named Smooth Love Potion (SLP), transactions within the game, and used for prizes.

Non-Fungible Tokens – In 2021 Non-fungible tokens gained favour. NFTs are tokenized digital things made using Ethereum. Commonly speaking tokenizations give one digital help with a specific digital token that specifies it and stores it on the blockchain. This confirms ownership as the encrypted stores and the owner’s wallet address. The NFT can be traded or marketed and is viewed as a transaction on the blockchain. NFTs are being developed for all sorts of assets. For example, sports fanatics can purchase a sports token- also called fan tokens- of their famous athletes, which may be treated like trading cards.

The Development of DAOs – Decentralized Autonomous Organizations a combined process for making findings across a dispersed network, are being developed. For example, imagine that you make a venture capital fund and increase money through fundraising, but you want decision-making to be decentralized and allotments to be automatic and transparent. A DAO could use smart agreements and applications to collect votes from the fund’s members and purchase ventures based on the majority of the group’s votes, then automatically distribute any returns. The trades could be viewed by all parties and there would be no third-party involvement in giving any funds. In this article, we will cover all the important information so read the full article.

Also read: What Is Litecoin: How Does LTC Work?

How Can I Buy Ethereum?

Investors can use the best cryptocurrency exchange platforms to purchase and sell there. It is supported by reliable crypto exchanges, including Gemini, Binance, brokerages Coinbase, and Kraken like Robinhood.

- How Does Ethereum Make Money?

Ethereum is not a centralized institution that makes money. Validators who participate in the Ethereum network earn ETH tips for their assistance.

- Is Ethereum a Good Investment?

Now people want to know if is Ethereum a good investment. The answer to that depends on your financial objectives, risk tolerance, and purposes. The cryptocurrency EHT can be volatile, putting capital at risk. However, it has been worth exploring as an investment as the diverse existing and emerging creative technologies that use Ethereum may assume more extensive roles in our society in the future. Think about taking a cryptocurrency trading system to assist you set up the right investment strategies.

Is Ethereum a Cryptocurrency?

The Ethereum platform has a native cryptocurrency, known as ether, or ETH. Ethereum itself is a blockchain technology site that sustains a wide range of decentralized applications including cryptocurrencies. The ETH coin is generally called Ethereum, although the distinction remains that Ethereum is a blockchain Ethereum is a blockchain-powered platform and ether is its cryptocurrency.

Can Ethereum Be Converted to Cash?

Yes, investors who have the cryptocurrency ETH can utilize online exchanges such as Gemini, Coinbase, and Kraken for this method. Just establish an account at the exchange, link a bank account, the send ETH to the exchange account from an Ethereum wallet. Place an order on the exchange to sell ETH. Once sold, transfer the U.S. dollar earnings to the connected bank account.

The Bottom Line

Ethereum is a decentralized blockchain platform. It encourages designers to make and deploy smart contracts. It uses its native cryptocurrency, Ether, for commerce and incentivizing network accord mechanisms. Funding in cryptocurrencies and initial coin giving is positively risky and speculative. Swipe up the next page for more information about it.

Disclaimer

Join 120 million enlisted users trading the world’s most famous cryptocurrencies. Buy and trade Bitcoin, BNB, Ethererum, and Binanc4e’s native coin. If you have been a beginner trader, crypto, enthusiast, or experienced, you will profit from access to the international crypto markets while appreciating some of the lower fees in the business. Plus, guides, and devices that make it easy to safely and securely sell, purchase and convert NFTs on the Binance app. Stay connected with us for more updates.

Leave a Reply